Accidents have become more common in India as the number of vehicles on the roads has increased. Even if you are driving/riding your bike safely, a mishap may occur due to the negligence of another person. Such incidents can cause physical harm as well as damage to your vehicle. You will then be responsible for the repair costs. This will not be the case if you insure your two-wheeler vehicle.

When buying insurance for a two-wheeler, there are two types of Two-Wheeler Insurance policies available to you for motorbikes or scooters:

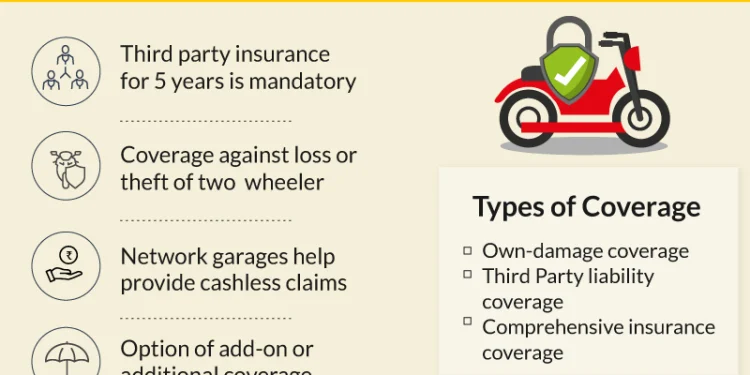

- Third-Party Liability- This coverage ensures that you are financially protected in the event of third-party property or person damage or injury. This policy covers any legal issues that may arise, and it is therefore required to have one. *

- Comprehensive Policy- In comparison, this two-wheeler insurance plan provides extensive coverage and financial protection against both own damage and third-party liability. Not only that, but it protects your bike from any losses caused by natural or man-made disasters. This policy also includes theft coverage. *

Here are a few things to look for when purchasing two-wheeler insurance:

- Online Policy Purchase

When choosing an insurance company, see if they offer the option of purchasing two-wheeler insurance online. This feature eliminates the need for middlemen, and all payments are processed through secure payment gateways. According to the law, all vehicles must have at least a two-wheeler insurance third-party policy. This cover will be useful if you collide with someone else’s bike and cause damage to their vehicle. You can also use a two-wheeler insurance premium calculator online.

- Personal Accident Insurance

Check to see if your insurance company provides a Personal Accident Shield to cover your co-passengers.

- Round-the-clock service

When choosing an insurance policy, check to see if they are available to answer your questions 24 hours a day, seven days a week.

- Obtaining a Long-Term Insurance Policy

If you get a long-term insurance policy, you won’t have to deal with the hassle of renewing your two-wheeler insurance every year. Also, people frequently forget their policy’s expiration date, so this is useful.

- Cashless Claims Services

Most insurers offer cashless services to their customers. They have a list of network garages where you can take your vehicle for repairs, and your insurance provider will pay the repair bills. As a result, look for an insurance company that provides you with a long list of these garages where you can make cashless claims. *

- Payment Mode

Nowadays, almost all insurers offer net banking as well as mobile banking and EMI options. When choosing an insurance company, consider the ease of payment.

In addition to the features listed above, consider the number of additional two-wheeler insurance coverage offered by your insurance company. Add-ons supplement your current comprehensive policy. Accident Shield, Lock & Key Replacement Cover, 24-Hour Roadside Assistance, Consumables Expenses, Zero Depreciation Cover, and Engine Protector may be available from the insurance company. To purchase these covers, you must pay a small premium; therefore, select the add-ons based on your needs. *

You can evaluate your current insurance for a two-wheeler plan now that you have a clear understanding of what an adequate two-wheeler insurance policy should include. If you believe your bike insurance policy is insufficient, you can replace it or purchase add-ons when your policy is renewed. Using an online portal can significantly improve your understanding of policies and help you compare them better. This is true for costs, types of coverages, and the payouts available under each policy. Do remember to read the fine print, as certain terms have exceptions to them.

* Standard T&C Apply

Insurance is the subject matter of solicitation. For more details on benefits, exclusions, limitations, terms, and conditions, please read the sales brochure/policy wording carefully before concluding a sale.